"Recession" is a 4-Letter Word

Jobless claims: Highest since Katrina (CNNMoney.com)

On March 26, 2008, "President" Bush visited a small business in Sterling, Virginia where he promoted his economic stimulus package (see speech "President Bush Visits ColorCraft of Virginia, Inc., Discusses Stimulus Package, Economy"). At no point did he mention that horrible word "recession." He did however refer to the economy as enduring a "downturn" and even a "rough patch", but he is "confident in the long term we'll come out stronger than ever before." And that the best way to do this is "to give people their money back so they can spend it." Admittedly, "it's going to take a while for the economy to feel the effects" but until then we can "rest assured" that "in the long term we'll come out stronger than ever before."

The Great Inflation Cover-up (CNNMoney.com-Fortune)

Fed official: Economy 'all but stalled' (CNNMoney.com)

80,000 job losses, unemployment spikes (CNNMoney.com)

On March 26, 2008, "President" Bush visited a small business in Sterling, Virginia where he promoted his economic stimulus package (see speech "President Bush Visits ColorCraft of Virginia, Inc., Discusses Stimulus Package, Economy"). At no point did he mention that horrible word "recession." He did however refer to the economy as enduring a "downturn" and even a "rough patch", but he is "confident in the long term we'll come out stronger than ever before." And that the best way to do this is "to give people their money back so they can spend it." Admittedly, "it's going to take a while for the economy to feel the effects" but until then we can "rest assured" that "in the long term we'll come out stronger than ever before."

Oh, is that so, Mr. "President"? How can you explain to the 7.815 million people now unemployed to be patient because in the long term things will be better? "Oh, don't worry. I know the banks have foreclosed on your home and you can no longer make ends meet, but if you wait until, say, 2010, it will all be OK. At that time the housing crisis will be over and the economy will be better. And it will all be the result of this 'good law that I signed.'"

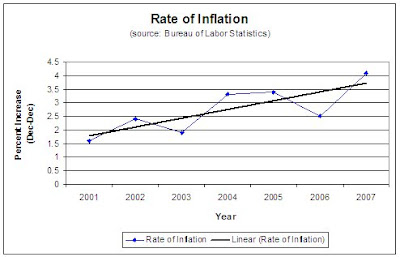

The data below show the rate of inflation since 2001 as well as the rate if unemployment over the last 13 months from the Bureau of Labor Statistics latest information.

According to this information, the rate of inflation has been increasing since 2001. That is to say, the buying power of the $US has been falling at an increasing rate. Or, prices have been rising faster and faster each year. It has been argued that if we focus only on "Core Inflation" (the rate of inflation without the volatile fuel and food market) that the rates are not at all alarming. So in other words, if we tell the consumer that if you don't buy fuel to run your car or heat your home, and if you don't buy food, then your should be 'OK' and won't feel the full effects of inflation. Economists who use only core inflation to measure the rate of inflation are ignoring the human factor of the economy - these are essential items to human consumption. And if an economist ignores the human factor then EVERY economic model can be thrown out since they are all based on how consumers will make their economic decisions. This is when economics as a science becomes irrelevant. The only way it can remain relevant is if economists remember the source of all economic data are the consumers and the tendencies of consumers when they make economic choices. The study of economics for its own sake is pointless. (Which can be said of any social science - social sciences must be studied in a way that makes it relevant to the student - but that is a discussion for another day.)

According to this information, the rate of inflation has been increasing since 2001. That is to say, the buying power of the $US has been falling at an increasing rate. Or, prices have been rising faster and faster each year. It has been argued that if we focus only on "Core Inflation" (the rate of inflation without the volatile fuel and food market) that the rates are not at all alarming. So in other words, if we tell the consumer that if you don't buy fuel to run your car or heat your home, and if you don't buy food, then your should be 'OK' and won't feel the full effects of inflation. Economists who use only core inflation to measure the rate of inflation are ignoring the human factor of the economy - these are essential items to human consumption. And if an economist ignores the human factor then EVERY economic model can be thrown out since they are all based on how consumers will make their economic decisions. This is when economics as a science becomes irrelevant. The only way it can remain relevant is if economists remember the source of all economic data are the consumers and the tendencies of consumers when they make economic choices. The study of economics for its own sake is pointless. (Which can be said of any social science - social sciences must be studied in a way that makes it relevant to the student - but that is a discussion for another day.)But if we combine the increasing rate of inflation with the increasing rate of unemployment we have a larger problem - stagflation (see the March 20, 2008 posting on "The Average Day" titled "Stagflation"). But what does the Unemployment Rate measure? Simply, it is the number of people who are "out of work." That definition is insufficient. It may lead people to believe that includes children, retired persons, stay-at-home moms, and disabled people. Unemployment only measures the portion of the population who are eligible, able, and desiring work - the "Workforce". So a 52 year old man who has decided to give up looking for work is not considered part of the workforce even if he is healthy and has bills to pay. Since he is no longer actively seeking employment, he is not considered part of the workforce. What is also deceiving is the exclusion of the "underemployed." Underemployed consists of people who are forced to take work that is below their qualification and experience. For example, the same 52 year old man has a PhD in Aerospace Engineering yet his company has downsized and cut his division. He must now compete with equally qualified individuals younger than himself. The big difference is that he will command a higher salary than those 20-25 years his junior and so becomes less marketable. In addition, working against him is his age and potential health risk, which again ups the overall cost of a firm to hire this worker. As a result, this individual may be forced to take a job for which he is overqualified - anything from, in the worst case scenario, retail at a department store, to perhaps store manager. Is this person employed? Yes he is. Is he commanding the salary he deserves based on his experience and training? Not at all. Again, leaving out the human element to economics.

But "Recession?" Not us, not now. What is the "President" doing to head off this "rough patch?" Giving everyone who files their taxes this year $600 dollars! Now that is a reason to celebrate! Isn't it? Why don't you look any happier? Oh, yes, I know, fuel prices are continuing to rise and that $600 will simply be eaten up in fuel costs. Oh, that's OK. That is money you would have spent on fuel anyway, right? But look on the bright side, if own stock in one of the Big 5 oil companies you will earn greater dividends. Now that is something to celebrate. (See post "April Fools'! The Joke Is on the Consumer")

If we admit that we are in a "recession" then how would that look for the President? How would that look for our economic leader? How will that tarnish his legacy as president?

For more anti-Bush paraphernalia, visit http://www.cafepress.com/thewhitehouse.

For more anti-Bush paraphernalia, visit http://www.cafepress.com/thewhitehouse.Labels: Bush, caggia, economics, everyday, fuel, gas, GDP, inflation, matt's meandering meditations, news, politics, Preisdent, the average day, unemployment